Now Europe, now Eurobonds!

Ska Keller, President of the Green Group

Sven Giegold, MEP German Greens

Bas Eickhout, MEP GroenLinks

Ernest Urtasun, MEP En Comú Podem

In the last days, we have witnessed an inexplicable European paralysis to address the COVID-19 crisis. It has taken too long to see patients crossing borders to be treated in neighbouring countries, or material circulating from one country to another. Fortunately, it seems that solidarity within Europe is growing every day, and we are finally reacting on the health-care front.

However, another crucial debate is now taking place: what shared response will we give to the very hard economic downturn that the continent is going to suffer after these months of economic and industrial standstill? So far, two major measures have been announced: firstly, the release by the European Commission of unspent structural funds, which could mobilise up to 37 billion euro. And secondly, the new programme for buying bonds from the European Central Bank, worth 750 billion euro. Both measures are important and show that the "federal" institutions are indeed acting with agility and speed.

The Commission has also proposed the new "SURE" programme to support the costs of temporary unemployment through loans, a programme that has yet to be approved.

We cannot say the same, however, for the European Council. After two failed Eurogroup meetings, on March 26th European Council was a veritable ceremony of confusion. Our governments gave such a sense of paralysis and disagreement that some have already begun to question whether it is the European project itself that is at risk. Today Europe is the epicentre of the pandemic, and we are lagging behind in the economic response at global level.

The reality is that the breakdown of the European economy will require a programme of reconstruction unparalleled in recent years. To think that such a huge amount of investment can be made simply from national debt with the support of the ECB is totally illusory, a path full of risks that is also less democratic and economically dubious. That is why we believe that it is now essential to make the leap to a shared debt instrument, aimed at jointly mobilising resources in order to be able to implement a genuine European reconstruction plan. It is only through shared actions that we will be able to mobilise a sufficient amount of resources. This issue must also go hand in hand with shared instruments for managing expenditure, and with greater control of this instrument by the European Parliament.

Issuing shared debt is not currently a gesture of solidarity between some countries, it is an essential step forward if we want to prevent the euro and the internal market from entering a critical spiral, the effects of which would be felt by all the countries of the Union as a whole. It is in the interest of the entire eurozone to minimise the economic depression induced by the fight against the virus and there is no “moral hazard” that will be worthwhile: the shock is symmetrical and will affect everyone equally. The argument of "moral hazard" is even less acceptable if we consider that Germany has been the main beneficiary of the implementation of the single currency in recent years, and that the Netherlands maintains tax schemes that undermine the income of the other Member States.

Now is also not the time to think about the failed bailouts of the past. Offering countries like Spain or Italy a European Stability Mechanism rescue programme, conditional on greater austerity, is profoundly short-sighted and is something that public opinion in the countries most affected would perceive as a humiliation of their partners at one of their most critical moments. To resort to an ESM programme now would be equivalent to if the US government's decided in 2005 to burden Louisiana's growth for years with the entire debt incurred in rebuilding following Hurricane Katrina. From such a proposal, one could only expect an unstoppable growth in disaffection towards the European project. Even an unconditional ESM credit line, as some in the Eurogroup seem to suggest, would clearly be insufficient.

It is Europe's time. Jacques Delors, in a recent interview, has warned of the return of nationalism in the European Council. We pro-Europeans must react. It is time for a European response on all fronts: on the health front, by providing material support and assisting countries when their health systems become saturated (as well as by joining forces in coordinating and directing scientific research) and on the economic front, by creating truly European financial reconstruction mechanisms such as Eurobonds.

The last European Council mandated the Eurogroup to examine the different options. Of the 19 countries that make up the euro area, more than 8 have already given their approval to the instrument. At this critical time, we would like to call on the European public to mobilise to achieve this objective, overcoming the resistance that some countries are still putting up. Europe must give a signal that it is up to the task and that it is capable of reacting with risk and ambition. The future is at stake.

![[Translate to English:] [Translate to English:]](/fileadmin/_processed_/1/6/csm_CX5A3058_dcf6af16d7.jpg)

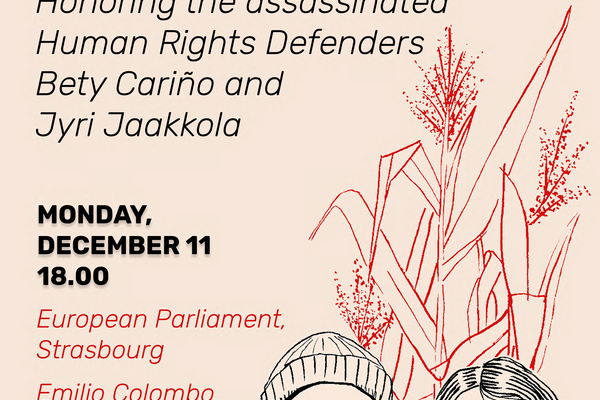

![[Translate to English:] Zeichnung von einem Mann und einer Frau mit der Überschrift Bety y Jyri.](/fileadmin/_processed_/5/1/csm_230614_BetyJyri-Website_96cba086d2.jpg)